Tax Saving 101: Keeping It In The Family – How hiring your children can save you thousands in taxes.

Now is a better time than ever to hire your children. We know, they’re lazy, they barely work, they have smart mouths, but hire them. We’ve all heard of keeping wealth in the family. By hiring your children to do actual work for your company, their income may be a deductible expense for your business. There are some limits and stipulations, but yes you can pay your children to work for you, tax-free!

Why No One Should Start A Sole Proprietorship.

Forming a sole proprietorship for your business is probably not the best idea. Registering with the state is the first official step for many up and coming business owners. While some businesses file right away, others wait until they’ve seen a certain amount of return, warranting the action.

Knowing what type of entity to file can be confusing, but we can almost guarantee a sole proprietorship is never the answer. For most businesses, a sole proprietorship carries more disadvantages than perks. With that in mind, MATS is here to explain why it’s rarely a good idea to file as a sole proprietorship.

Expert Business Coaching $1500/m

Feeling stuck? Feeling like you’re making money but still broke? Let a Madison’s Business COACH lead on a path that: Organizes your business, increases monthly revenue, and to sustain a growth pattern.

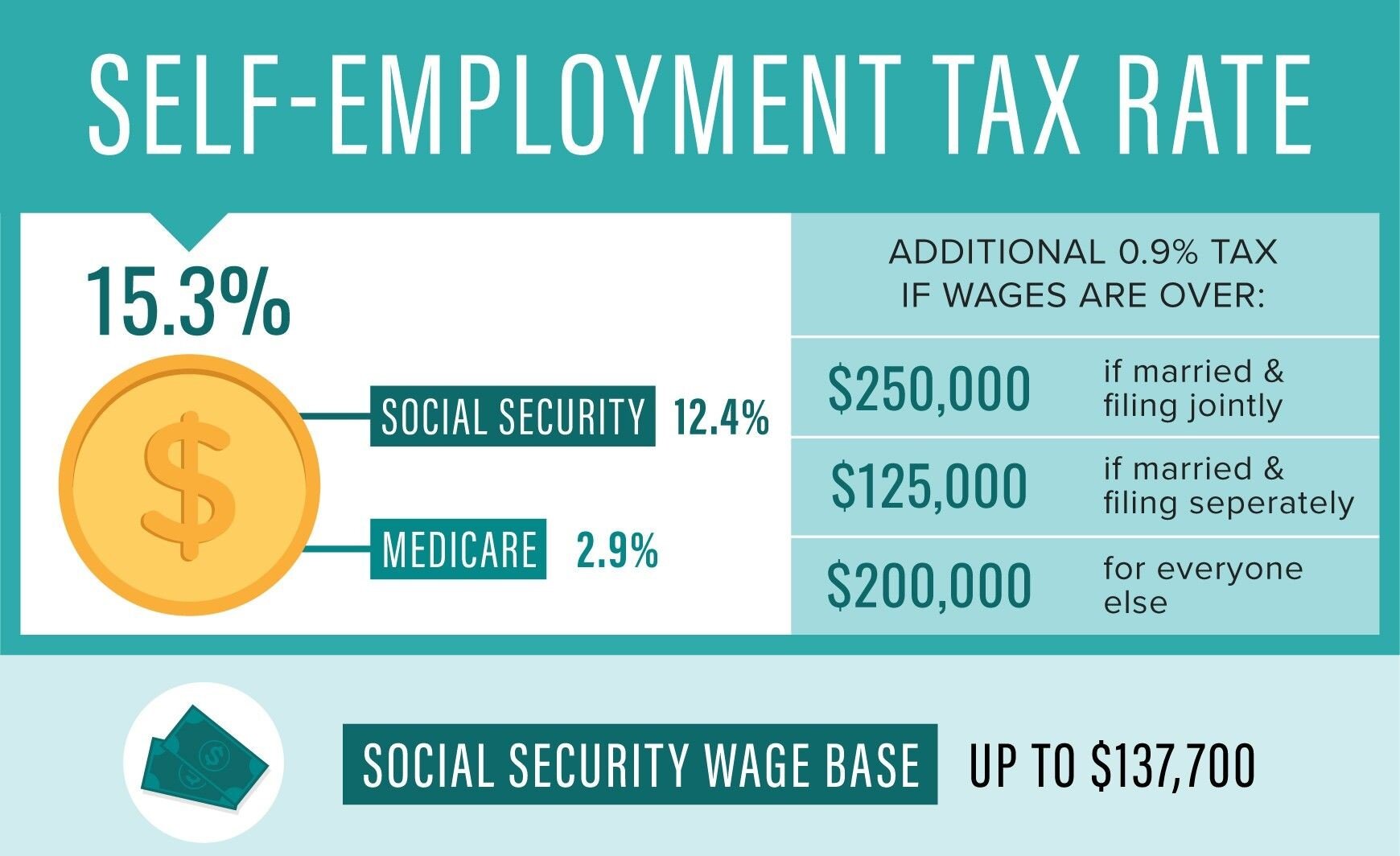

Self-Employment Tax: What is it, And How is it Calculated? 2020

Self-Employment Tax - What is it & How it is Calculated